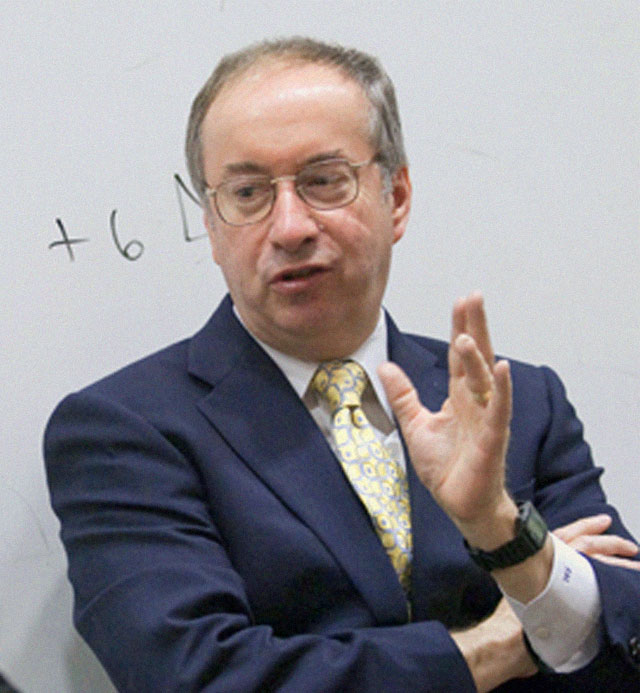

Francis A. Longstaff

Education

Ph.D., finance, University of Chicago

Summary of Experience

Throughout his more than 40-year career, Professor Longstaff has developed a deep knowledge of all aspects of financial valuation. He is known for developing the Longstaff-Schwartz model, a multi-factor short-rate model; and the Longstaff-Schwartz method for valuing American options by Monte Carlo simulation. These valuation models have been used widely on Wall Street and throughout the global financial markets. He regularly consults to financial institutions, including mutual funds, hedge funds, and commercial banks, as well as to risk management firms. Professor Longstaff has taught at UCLA since 1993, and his research includes fixed income markets and term structure theory, derivative markets and valuation theory, credit risk, computational finance, liquidity and its effects on prices and markets, and the role of arbitrage in financial markets. Earlier in his career, he served as the head of fixed-income derivative research at Salomon Brothers, Inc., in the research department of the Chicago Board of Trade, and as a management consultant for Deloitte Haskins & Sells. Professor Longstaff has published more than 70 articles in academic journals, including The Journal of Finance, American Economic Review, and the Journal of Financial Economics. He is a certified public accountant and a CFA charterholder.