-

Enhancing Product Value Propositions in the Pipeline

Many promising pharmaceutical products that survive the attrition inherent in scientific development and regulatory submission can expect to face another challenge – severe limitations on their commercial value due to payer concerns about cost and clinical effectiveness. Novartis, for example, opted not to market the EMA-approved drug Rasilamlo in Germany due to the authorities’ assessment of its limited differentiation and consequent unwillingness to accept a premium price.

The lesson: not only are effective value propositions necessary for commercial success, but building them should be a strategic imperative during the development process. Companies and product teams need an understanding of what the market values and what evidence is necessary to support a price premium above that of the standard of care prior to late-stage development; otherwise, the evidence will not be available at launch. In addition, they need to consider up front how to structure payer contracts designed to share risk and to ensure favorable market access.

Using Value Analytics to Forecast Market Access Outcomes

Companies can optimize product value propositions for their pipeline assets by applying multiple tools, including primary research, evidence review, and early-stage cost-effectiveness and budget impact analysis. The approach we have used incorporates the fundamental uncertainties in the product profile and the future competitive environment, paired with the key product development strategy decisions, to evaluate how well the product will perform against physician and patient expectations as well as those of the payer. We use economic modeling combined with primary and secondary research to forecast the likely market access outcome – that is, payer imposed restrictions on utilization or cost burden on the patient – and the resulting implications for the product’s market share and revenue forecast.

Recently, for example, a manufacturer’s asset was entering Phase II development and appeared to have potential under two divergent clinical development strategies, one emphasizing side-effect mitigation, the other, efficacy maximization. The company had not previously drawn on a structured, data-driven method for making payer value proposition implications part of its strategy – but by developing an early-stage, scenario-based cost-effectiveness and budget impact estimation model, management was able to make early estimates of some of the key metrics that influence payer decision making.

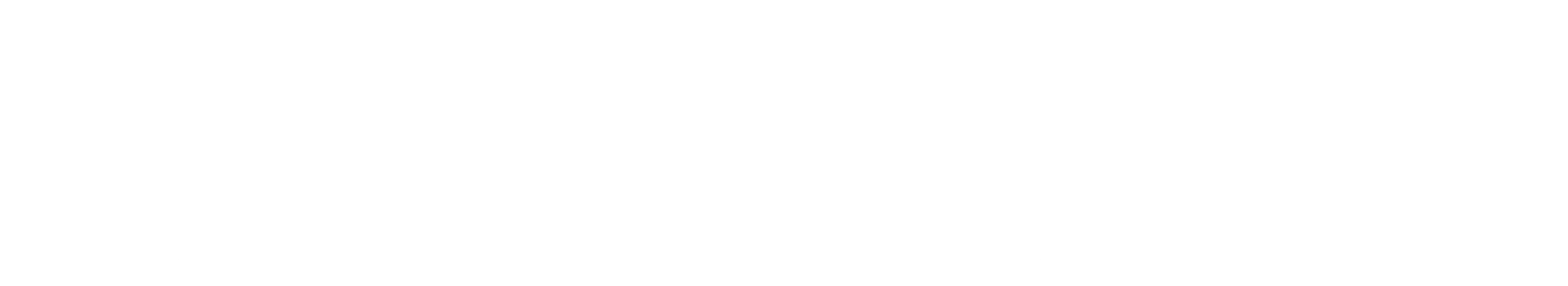

With different potential target patient segments, varying value proposition criteria, and alternative strategies under consideration, the project team decided to develop a visual dashboard (see Figure 1) combining modeled values for comparing likely value propositions given a strategy choice, patient segments, and market characteristics.

Figure 1. Strength of Value Proposition by Patient Segment and Disease Subtype

The narrow strategy delivers the best results but in a small population.

The analysis revealed that the side-effect mitigation strategy offered potential for very high differentiation and price premia, but only in a limited patient segment. The strategy emphasizing efficacy had broader market potential but greater competitive risk. In addition, a more optimistic hypothesis – that the side-effect mitigating strategy could have broad market impact – was probably unrealistic. Bringing the value proposition into the clinical strategy dialogue earlier than before possible helped guide the development of evidence that will better align with payer requirements once the product comes to market.

Risk Sharing in the Pipeline

Recently, Roche proposed a risk-sharing or pay-for-performance agreement for Avastin to German hospitals and insurers through which, it has been reported, Roche will refund the cost of the drug if patients experience disease progression within three to seven months after first-line treatment. While such contracts are not new – several have been proposed in the UK – the Roche proposal attracted attention because of the new German federal drug pricing law that permits this type of agreement and the potential for direct involvement of hospitals in risk-sharing arrangements.

If the Roche agreement represents a prototype for future contracts designed to ensure favorable market access, how might a manufacturer evaluate the tradeoffs associated with such an agreement, especially in very early phases of drug development when market access and pricing strategy are increasingly being considered in parallel with the clinical development plan? What is the impact of potential risk-sharing agreement(s) on the value of early-phase assets? Consider, for example, a novel oncology drug being developed for a potential metastatic breast cancer indication, where the target product profile (TPP) includes expectations of 15.3 and 23.6 months for progression-free survival and overall survival, respectively. In markets where cost-effectiveness or budget impact criteria are used in coverage and reimbursement decisions, a rebate scheme may be introduced when the product is launched to achieve a cost-effectiveness ratio or budget impact consistent with conventional thresholds of acceptability as part of a global pricing and market access strategy.

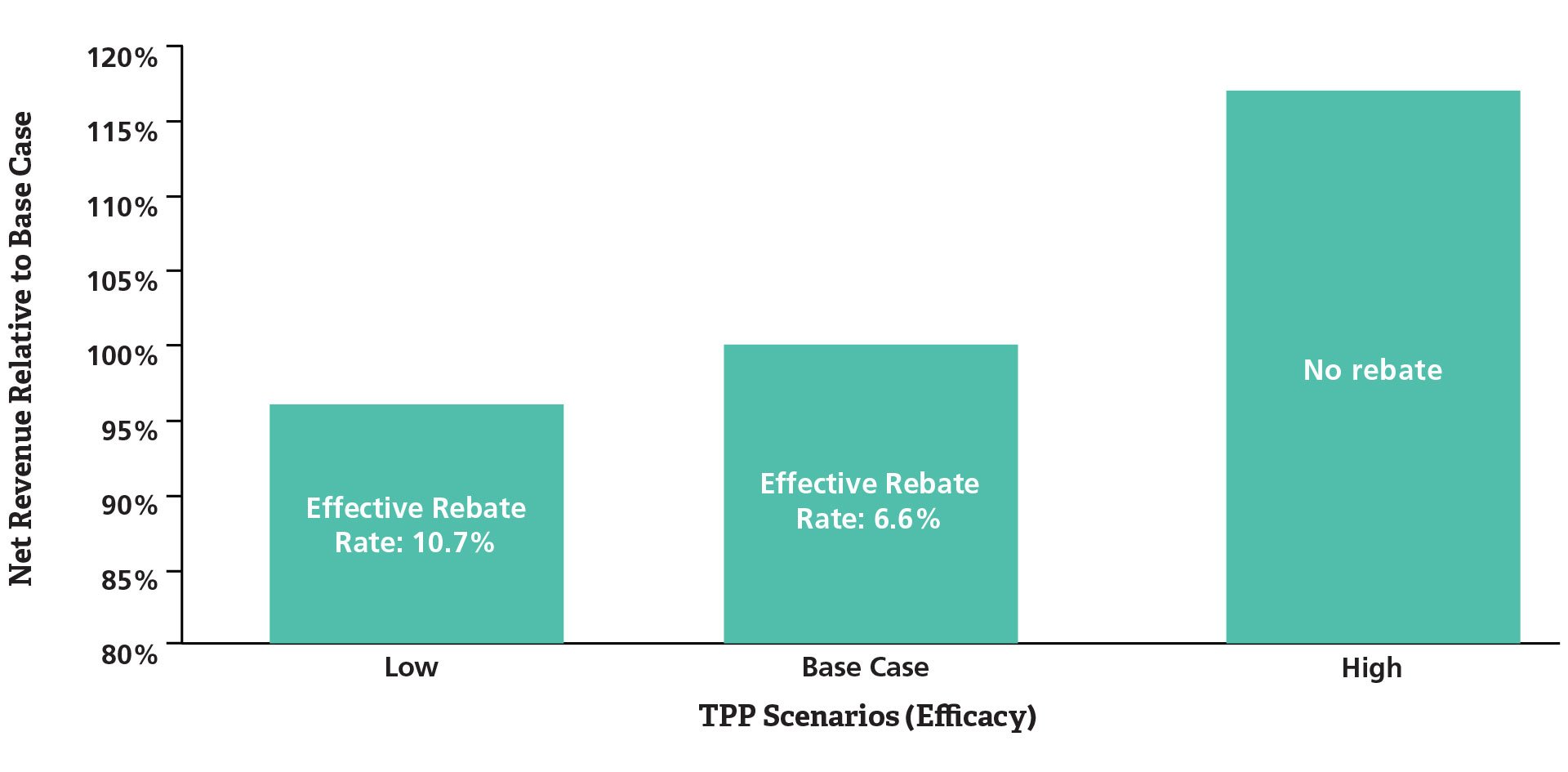

With an estimated survival curve based on target product profile assumptions about efficacy and pricing, the potential impact of a simple rebate scheme where the manufacturer provides a refund for the drug for patients who progress before a specified number of months can be explored. Figure 2 illustrates alternative efficacy scenarios for the hypothetical investigational drug and the resulting net revenue and effective rebate rate given a 10 percent price premium assumption and an expectation of maximum duration of therapy of 18 months.

Figure 2. Potential Net Revenue Impact of Risk Sharing under Varying Clinical TPP Scenarios

Lower efficacy will require greater rebate amounts.

The effective rebate rate, or the total amount refunded divided by the total revenue, varies depending on the relative efficacy of the investigational drug, which may have implications for clinical study design given a desired global pricing strategy. With the objective of a 10 percent price premium, given a cost-effectiveness threshold of acceptability, and overall market access objectives, these analyses provide quantitative information that highlights the imperative for pursuing efforts to increase the likelihood of a “best case” efficacy scenario. In addition, the analyses highlight the potential cost to the organization if this outcome is not achieved. There are significant opportunities to integrate market access strategy into product development decisions in early phases, and the case studies presented here illustrate the range of issues that may be addressed with data-driven analyses. ■

-

Edward Tuttle is a Managing Principal and Anita Chawla, Ph.D., is a Senior Advisor in the Menlo Park office.

From Health Care Bulletin: Winter/Spring 2012